If you’ve been hesitant about buying a home due to high mortgage rates, it may be time to reconsider. Recent trends show that mortgage rates have dropped significantly, creating a valuable opportunity for homebuyers.

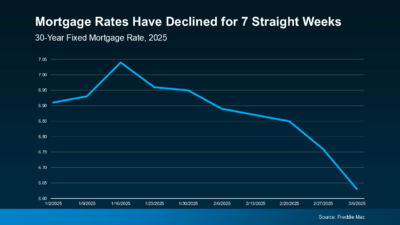

According to Freddie Mac, mortgage rates have steadily declined for the past seven weeks, reaching their lowest point of the year. This decrease from over 7% down into the mid-6% range may not seem drastic, but it could significantly impact your buying power and affordability.

Why Are Mortgage Rates Falling?

Joel Kan, Vice President and Deputy Chief Economist at the Mortgage Bankers Association, points out that economic uncertainty is behind this recent decrease:

“Mortgage rates declined due to weakening consumer confidence about the economy and uncertainty regarding new tariffs on imported goods. This resulted in the most notable weekly drop in rates since November 2024.”

This decline arrives at an ideal moment, providing homebuyers relief just as the active spring housing market gets underway. However, mortgage rates can fluctuate quickly, so it’s essential to take advantage of this window if you’re prepared to purchase.

What Does This Mean for Your Budget?

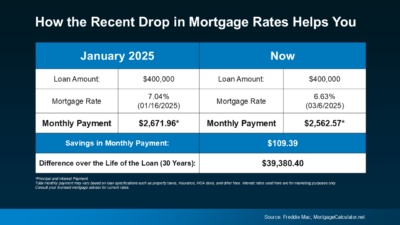

Even a small rate drop can significantly reduce your monthly payments. For instance, on a $400,000 loan, the recent rate decrease from around 7.04% in mid-January to current levels could lower your monthly principal and interest payments by over $100. This saving adds up considerably over the life of your loan and could make homeownership more achievable for many buyers.

The Bottom Line

Mortgage rates have declined, providing homebuyers a timely opportunity to enter the market with improved affordability. However, rates can be unpredictable, so acting swiftly can be beneficial.

Considering buying a home now that rates are lower? Let’s connect to evaluate your options and ensure you make the most informed decision possible.