Buying a home is likely your most significant investment, so protecting it with homeowner’s insurance isn’t just smart—it’s essential. While we hope the worst never happens, having the right insurance gives you peace of mind and security when you need it most. Here’s why homeowner’s insurance is crucial:

How Homeowner’s Insurance Protects You

Repair and Rebuilding Coverage:

If your home suffers damage from events like storms, fires, or other disasters listed in your policy, homeowner’s insurance covers the cost to repair or even rebuild your home entirely.

Protection for Personal Belongings:

Homeowner’s insurance typically covers your personal property such as furniture, electronics, clothing, and other valuables if they’re stolen or damaged by covered events.

Liability Protection:

If someone is injured on your property, your policy can help cover medical bills, legal fees, or other related costs.

Ultimately, homeowner’s insurance provides invaluable peace of mind, safeguarding your home and financial well-being against unexpected challenges.

Rising Costs and Claims: What’s Causing the Increase?

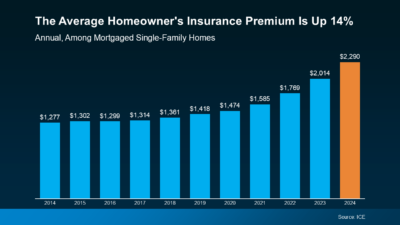

Recently, homeowner’s insurance premiums have been on the rise. According to Insurance.com, the key factors behind these increases include:

- Severe weather and natural disasters leading to higher claim volumes.

- Insurance companies withdrawing from high-risk areas, reducing coverage options.

- Inadequate past rate adjustments not keeping pace with increased claims.

- Higher rebuilding costs due to inflation impacting labor and materials.

These factors have driven insurance premiums higher over recent years, emphasizing the importance of budgeting carefully for homeowner’s insurance.

How to Keep Costs Manageable

Though rates are rising, there are strategies to help manage your homeowner’s insurance expenses:

- Shop Around: Compare quotes from multiple insurance providers to find the best balance of coverage and price.

- Ask About Discounts: Many providers offer discounts for installing security systems, bundling insurance policies, or making home improvements that reduce risk.

- Regularly Review Your Coverage: Ensure you’re not paying for more coverage than you need, but always maintain sufficient protection for peace of mind.

Bottom Line

As you plan your homeownership journey, remember to factor homeowner’s insurance into your ongoing budget. Despite rising costs, careful planning, shopping around, and leveraging discounts can help you secure robust protection at an affordable rate.

Have questions about budgeting for homeownership or insurance coverage? Reach out—let’s ensure you’re fully prepared for the road ahead.